To get Aadhaar card or not is no longer a question. And linking it to one’s Permanent Account Number or PAN card is no longer a choice. Through the Finance Act 2017, the government has set July 1, 2017, as the deadline to link one’s PAN with the Aadhaar number. Failing to do so may lead to invalidation of your PAN card. If that happens, your PAN card will cease to serve as an identity proof, debarring you from transactions that cannot be carried out without quoting PAN. For instance, you may not be able to file your tax returns this year, since quoting Aadhaar and PAN numbers has been made compulsory. Similarly, without a valid PAN card, buying property worth more than Rs 10 lakh will not be permissible. The list is long.

Contents

Aadhaar-PAN linking simplified- How to link Aadhar-PAN Cards

Have you had to spend cumbersome time in linking Aadhaar details with those of your PAN card? Income tax department has a remedy for you. Due to some mismatches in personal details on Aadhaar card and PAN card, people failed to link both the documents crucial for filing returns.

The income tax department argues that once it concludes the exercise of linking Aadhaar with PAN, filing of income tax returns would be much more easier for the taxpayer.

Everything you need to know about the implications and impact of linking Aadhaar with PAN. pan card aadhar seeding, link aadhaar card to income tax return,unable to link aadhaar with pan,aadhar card link with mobile number,e filling pan card,aadhar card is enough for pan card,pan card with aadhar card,link aadhaar card to voter card.

Why linking Aadhaar Card with PAN Card

Once the Aadhaar-PAN linking is done, you can e-Verify your IT returns using Aadhaar and by linking the two cards you will no longer have to submit your Income Tax acknowledgement to the IT department.

If an individual applies for more than one PAN card, he/she can use one of the cards for a certain set of financial transactions and pay taxes applicable for those. In this process, the other PAN card can be used for accounts or transactions that the entity wishes to conceal from the Income Tax department and hence avoid paying tax on them.

If you are not linking your PAN to Aadhaar, chances are that it might be marked as invalid. The Aadhaar card has been marked as useful or mandatory for many types of application. If you haven’t linked your PAN to your Aadhaar, you should get it done before the July 1.

Once the Aadhaar-PAN linking is done, you can e-Verify your IT returns using Aadhaar and by linking the two cards you will no longer have to submit your Income Tax acknowledgement to the IT department. Another importance of Linking PAN Card with Aadhaar Card is that both are unique identification cards that serve as proof of identity that are necessary for registration and verification purposes. Another very important reason for linking PAN with Aadhaar is to reduce the occurrence of individuals or entities applying for multiple PAN cards to defraud the government and avoid paying taxes.

Step by step guide to link PAN card to Aadhaar Card:

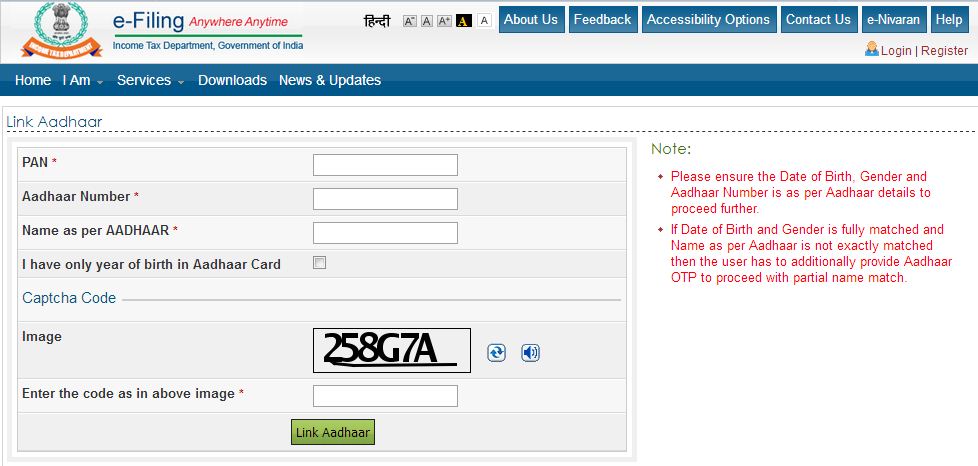

- First, log in to the e-Filing portal of the Income Tax Department portal, https://incometaxindiaefiling.gov.in/, if you are not already registered. The window will appear like this.

- After you log in, a pop-up window will appear, prompting you to link your PAN card with Aadhaar card. Details such as name date of birth and gender will already be mentioned as per the details submitted at the time of registration on the e-Filing portal.

- If the details match, enter your Aadhaar card number and captcha code and click on the “Link now” button.

- A pop-up message will inform you that your Aadhaar card has been successfully linked to your PAN card.

- If you have a pop-up blocker active, you will have to go on the “Profile Setting” on the dashboard’s menu bar to click on “Link Aadhaar” option.